Take Advantage Of Sector Rotation And Tax Policy Changes

As you know, materialized capital gains must be claimed, and losses, if any, can be materialized to offset claimable capital gains on your stocks and Exchange-Traded Funds (ETF) held in taxable accounts. Normally, people use the year-end to dump their losers and continue to ride their winners.

As you know, materialized capital gains must be claimed, and losses, if any, can be materialized to offset claimable capital gains on your stocks and Exchange-Traded Funds (ETF) held in taxable accounts. Normally, people use the year-end to dump their losers and continue to ride their winners.

I think that this year, investors might want to materialize their capital gains in some cases. There is a good chance the Trudeau government, to raise tax revenue to pay for spending, will need to raise the inclusion rate for the capital gains tax level. The talk that I have heard from accountants is a possibility for that rate to go from 50% to 75% in 2018. That’s a huge jump! This tax rate change is not an absolute of course, but it’s a possibility that we should take into consideration.

I’d like to present some thoughts below on combining a seasonal pattern with some tax considerations regarding our winning and losing stocks.

The Seasonals

There is a strategy that makes sense for investors looking to materialize gains or losses on their marketable securities. Markets tend to be strong into the end of a calendar year from this point. The tendency is for the big movers of the year to continue being the leaders until the end of December, while the laggards continue to sell off as investors unload them and materialize the loss. Come January; stock market participants start to look at the prior laggards to uncover some oversold/ underappreciated bargains. Thus, there can be a noticeable degree of rotation from leaders to laggards at the beginning of the year.

This does not imply that the current leaders will experience losses in January – it only implies that there may be less upside on those stocks as investors focus more on the laggards during that month. Investment strategies such as the “Dogs of the Dow” strategy were born from this phenomenon. Investors following the Dogs strategy buy the ten highest yielding stocks in the Dow Jones Industrial Average, which tend to be the prior year’s lower-performing stocks of the 30 stocks comprising the Index.

The Strategy

The strategy is to take gains on anything you suspect has run too high (and may be vulnerable to a period of underperformance) as the year-end approaches. Possibly you are concerned about the runaway NASDAQ Index. In this case, if you feel that the NASDAQ market might take a breather in the New Year, you could take some profits on that sector by selling a NASDAQ ETF, a technology ETF or individual stocks as the year comes to an end. This will materialize your capital gain at current rates of inclusion, unless the Trudeau administration makes a capital gains tax change before year-end.

Remember, you can always buy your ETF or stock back. So, if the sold sectors or stocks take a breather or pullback in January, you could easily buy them back at the (hopefully) same or lower price. It may happen that you materialized a gain at a lower tax rate in 2017, which may indeed offset any risk of losing out on some of the upside, should the ETF or stock continue to rise in the first month of 2018. It’s a game of odds, but odds are somewhat in favour for some rotation of the guard from strong to weak sectors for the first month of the year. Some of the losing sectors that might be worth looking at include retail, energy, consumer staples and precious metals for that January rotation.

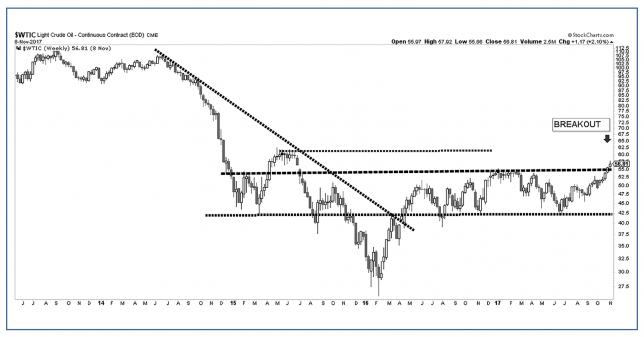

Watch for a base and breakout pattern on a weak sector as the new year approaches. The energy base breakout has already started. W & T Offshore Inc (WTI) broke through $56 in November – which was a significant point of technical selling pressure for that commodity in the past. The producers have a large bit of room to play catch-up if oil stays over that $56 level.

The Tax Side

True, you could materialize your losses on underperforming sectors this year and use them to offset any materialized gains. Perhaps you bought precious metals, energy, or consumer discretionary ETFs when they were higher. These losses could be used to offset your gains on the outperformers that you take profit on this year. However, if you believe as I do, that there is a chance of higher capital gains inclusion rates in 2018 – you could choose to claim your losses in 2018.

A realized loss in 2017 might be more beneficial next year if capital gains inclusion rates go up in 2018. Conversely, a capital gain realized in 2018 could be taxed at a substantially higher rate – offsetting any short-term upside gained over that 30-day buy-back period. It’s your after-tax returns that count.

The Takeaway

- Seasonal patterns suggest that weak sectors can sometimes pop in the new year, while strong sectors might take a pause.

- There is a potential for the capital gains inclusion tax rate to rise in 2018. This juicy source of new tax revenue for our “Spend liberal amounts of cash” government is a tempting tax grab that is more probable than some might think.

- If you feel you have stocks or sectors that are overbought, you might want to sell them before year end, then rotate into oversold sectors that are breaking out in January. By doing this, you might benefit from a market rotation into undervalued stocks, and take advantage of gains on potentially overvalued stocks. Further, you might avoid a capital gains taxes increase. While it’s no sure thing that capital gains will be taxed higher in 2018, better safe than sorry, I always say!

- If there is an increase in capital gains tax-inclusive rate, you would also benefit by deferring a tax loss sale until 2018. True, at this point we can still hold off claiming a loss for a later year if you do materialize a loss in 2017.

Keith Richards, Portfolio Manager, can be contacted at krichards@valuetrend.ca.

Keith Richards may hold positions in the securities mentioned. Worldsource Securities Inc., sponsoring investment dealer of Keith Richards and member of the Canadian Investor Protection Fund and of the Investment Industry Regulatory Organization of Canada. The information provided is general in nature and does not represent investment, accounting, or tax advice. It is subject to change without notice and is based on the perspectives and opinions of the writer only and not necessarily those of Worldsource Securities Inc. It may also contain projections or other “forward-looking statements.” There is significant risk that forward-looking statements will not prove to be accurate and actual results, performance, or achievements could differ materially from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements and you will not unduly rely on such forward-looking statements. Every effort has been made to compile this material from reliable sources; however, no warranty can be made as to its accuracy or completeness. As we are not engaged in rendering tax or accounting services please consult an appropriate professional regarding your particular circumstances before acting on any of the above.