The Wheel Of Riches – A Fable

Picture a massive stone wheel towering over the landscape. It sits at the bottom of a steep hill. A crowd gathers. They learn there’s a reward for pushing the wheel up the hill. The higher the wheel goes, the richer they will get. Some are skeptical. How could such a massive stone be budged? But a few enthusiasts step forward and put their shoulders against the stone. The wheel lurches and rolls forward. Encouraged, more join the effort. The wheel picks up speed. Now it’s up twenty feet, now forty feet, one hundred feet. The scene is incredible. Word spreads quickly, and the people in the surrounding countryside are amazed.

Picture a massive stone wheel towering over the landscape. It sits at the bottom of a steep hill. A crowd gathers. They learn there’s a reward for pushing the wheel up the hill. The higher the wheel goes, the richer they will get. Some are skeptical. How could such a massive stone be budged? But a few enthusiasts step forward and put their shoulders against the stone. The wheel lurches and rolls forward. Encouraged, more join the effort. The wheel picks up speed. Now it’s up twenty feet, now forty feet, one hundred feet. The scene is incredible. Word spreads quickly, and the people in the surrounding countryside are amazed.

Doubters are converted into true believers. People flock to join the crowd. The wheel extends a promise of wealth and provides its own proof. The new recruits put their backs into it. The slope becomes ever steeper but the crowd is unfazed. Two hundred feet. There are moments when there is an occasional slip, a loss of traction. The crowd regroups and strains ever harder. Up, the wheel grinds. The crowd roars. They can keep pushing the wheel up forever. The wheel ascends, powered by the force of pure enthusiasm. Three hundred feet.

But now the path gets steeper still. The crowd casts around for more disciples. They need more help. Exhaustion contorts their faces. There is no room for doubt but the whispers cannot be silenced. Where are the new recruits? The members of the crowd regard each other uneasily out of the corners of their eyes. Here and there along the edges, a few deserters skulk away. The weight of the wheel increases on those remaining.

At the hill’s steepest point, the wheel does something it’s not supposed to do. It stops. In that moment, the crowd realizes the plain truth: that the wheel has the power to crush them all.

The spell that enchanted the crowd breaks. Some turn to run, some are rooted to the spot. It looms over them. It starts to roll backwards. A rumble builds and disaster thunders down on the sea of upturned faces.

That in a nutshell is the story of every bubble in history. What makes it particularly relevant to us today is that we have front-row seats on the worst bubble in Canadian history, the one happening right now in real estate. Home prices in Toronto and Vancouver are ludicrous and prices in other cities are not cheap.

First a personal anecdote: I recently visited Toronto and looked into the real estate market. In the area of Yonge and Finch, houses are selling for around $1.6 million. These are not mansions, they’re plain single homes – three-bedroom, three-bathroom affairs. But here’s the scary part – similar houses in the same neighborhood were available for rent. The going rate? $2500/month.

Why is this frightening? Suppose someone bought a house for $1.6 million to rent out. The gross income would be $2500 x 12 = $30,000. Let us subtract, say, $11,000 for property tax and $5000 for utilities/maintenance and miscellaneous expenses. That leaves a net income of $14,000 per year. How many years will it take to pay back the original investment?

$1.6 million/$14,000 = 114 years.

Here’s the kicker. This assumes the buyer bought this house in cash, without a mortgage. With a mortgage, the buyer will never make his investment back from rent alone. The payment on interest for a typical mortgage could be $3000 or more every month. Every year, he will need to throw upwards of $36,000 into the maw of this “investment”. He thought he bought a house, but he’s got a black hole instead.

Even a lowly GIC paying 2.5% annual interest will earn back your original investment in less than 40 years. Since real estate is more risky than a GIC, I would want the payback period to be shorter than for a GIC. Something under 25 years would be reasonable. If we work backwards a 25-year payback period implies a fair price of $350,000 ( = $14,000 X 25 yrs).

Prices need to fall 75% before they would reach an economically sensible level. The real estate “investor” of today has to rely on a continual flood of new buyers willing to pay nonsensical prices.

How did the real estate bubbles in Toronto and Vancouver come about? The mechanism behind bubbles are so well known you can come up with a recipe for them:

Start with a period of low interest rates, so people can borrow money to gamble with. Juice things up with a generous helping of the cognitive biases that everyone suffers from (overconfidence, confirmation bias, anchoring, recency1). Stir in the enablers (banks and mortgage lenders, real estate brokers). Let the stew stand for a while, then step back. Step well back.

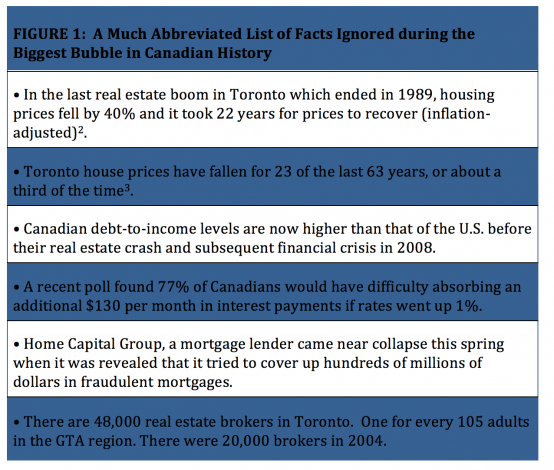

I started writing about the dangers of a real estate collapse four years ago. I was too early. I thought that the example of the US bubble would serve as a sobering influence. I was completely wrong on that. It appears there are no sobering influences. Warnings have appeared in The Economist and Macleans. Even the Bank of Canada has chimed in. (This is unprecedented, usually the central bank is the last to admit there’s a problem). The facts are clear but facts don’t matter to the speculative crowd (see Figure 1).

Here are the only two things you need to know about real estate bubbles:

First, they always end. Second, when they do end, they don’t “unwind”, they pop. They aren’t called bubbles for nothing. The tragic thing about this is that many people who weren’t anywhere near the Toronto or Vancouver real estate market, who don’t even own a home will also get hurt. When prices plummet, buyers default on their mortgages. Banks restrict their lending and that puts a chill on the entire economy. People lose their jobs and we are caught in a vicious downward spiral.

But what about the “soft landing” scenario. Forget it. All the landings for every real-estate bubble in history have been hard. The idea of the soft landing is nothing more than a fairy-tale told by economists and politicians to avoid having to face the horrible consequences of speculative madness.

What do you do to prepare for the coming storm? Do the opposite of the crowd. While they are getting deeper into hock, you should be getting out of debt, building up financial reserves. When the bubble collapses it will not be pleasant. You want to provide a cushion for the downturn. And if possible a war chest to pick up the plentiful bargains that will present themselves not only in real estate but also the stock market.

Nothing is certain in the world, but sometimes markets behave as if they were. It would be nice to believe that everything will turn up roses. It would be nice to think we could push that wheel of Riches to unlimited heights. It would be nice but it would not be wise.

Follow-up on my last column, September 2015

If you can remember that far back, I made a bunch of recommendations in the September 2015 column. One was to steer clear of Valeant Pharmaceuticals. Its stock price then was C$326.70. You probably know how that turned out. Two months later, the stock had crashed by two-thirds. And that was only the beginning. At the moment, it’s sitting at $21, a stunning 94% decline. The company’s fortunes collapsed because it was its own mini-bubble. It borrowed larger and larger amounts of money to buy overpriced businesses. To keep investors happy, it had to continue binging on debt. Sound familiar? It doesn’t matter if its pharmaceuticals or real estate, the story is the same and so is the outcome.

The second recommendation was to stay away from bank stocks. That one didn’t work out as well. The S&PTSX Banks index went from about 2400 to 3172 (July 24, 2017). I missed out on a 30% gain, not counting the dividends. I’m okay with that, I’m willing to sacrifice it for peace of mind – I don’t want to get squished by the wheel of Riches. I’m still bearish on the banks.

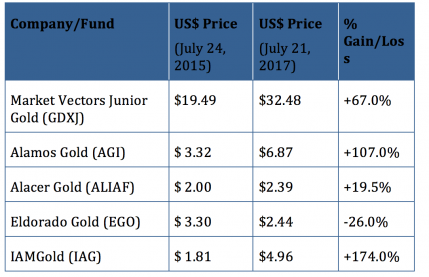

The third recommendation was getting into junior gold mining companies. I picked a wide spread of them:

(We’re going to drop Eldorado Gold from our recommended list. It’s the only laggard. I’d pick it up again if it hits US$1.50.)

I’m still bullish on gold. This has less to do with Canadian fundamentals and everything to do with the international situation. Gold is hovering around US$1200/oz. At this level, investors are not taking into account several major international economic and geopolitical risks.

First, levels of global debt have continued to soar. The wheel of Riches is in play in many places around the world. Nothing has changed in the bigger picture in the last two years. Greece, Italy, Spain and France have merely papered over their horrendous budgetary issues, which means the eventual bust will be even more severe. When push comes to shove, will the European currency regime survive?

In Asia, the financial flashpoint is China. The country has undergone a stunning transformation without historical precedent. But now, the Chinese government, desperate to keep the wheel turning, is using borrowed money to stoke an increasingly unresponsive economy. China’s debt-to-GDP ratio is hovering around 300% (compare Greece at 177% and Italy at 132%). A reckoning is inevitable and how it will play out is fraught with uncertainty given the lack of transparency.

In the Middle East, the defeat of ISIS means that the primary fault line for conflict will be between the Shiite bloc (Iran and its allies) and the Sunnis (Saudi Arabia et al). There is a perverse market incentive as well – conflict will send oil prices rocketing to $100/barrel or more.

In the U.S. the stock market has risen to new highs. The markets have priced in the tax cuts that Trump has proposed. This is a dangerous move. I expect a decline when the tax legislation passes. And given his track record there’s a distinct possibility that the cuts may not even happen. The disturbing fact is that the Shiller P/E ratio for the S&P index is at 30.5, its highest since 2000. The historical mean is 7. A bear market could happen as soon as October. The dysfunctional US administration increases the odds of an economic downturn.

Then there is a catch-all category of lower probability events such as a war between India and Pakistan, a pandemic, a high-casualty terrorist attack, hostilities in the South China Sea or on the Korean peninsula.

Finally the unknown unknowns. Who knows about these? No-one! These would be major geopolitical, economic, technological, or natural events that would have a profound global impact.

Summing up within the next five years I see:

- A 20% chance of a Eurozone breakup

- A 35% chance of a severe financial/political crisis in China

- A 25% chance of open hostilities in the Middle East

- A 20% chance of a severe bear market in the US (stock prices fall by at least 40%).

- A 15% chance of one of the catch-all scenarios

- A 5% chance of an unknown unknown.

Any one of these events would be enough to drive the price of gold past the US$2000 mark. If I do the math, the probability of at least one of them happening is around 70%. If more than one of them happens, gold could go to $4000.

Wynn Quon is Chief Investment Analyst at Legado Associates. I welcome your comments at wynnquon@gmail.com

1 I don’t have room to explain each of these terms but you can look them up in Wikipedia. Every investor should have a firm grasp of cognitive biases. Recently there have been some excellent books on the subject, e.g. Thinking, Fast and Slow by Daniel Kahneman.

2 https://betterdwelling.com/city/toronto/it-took-22-years-for-prices-to-recover-from-the-last-toronto-real-estate-crash/

3 http://www.huffingtonpost.ca/2017/01/18/house-prices-toronto-historic-boom-bust_n_14230574.html

4 http://business.financialpost.com/personal-finance/debt/more-than-quarter-of-canadian-mortgage-holders-in-over-their-head-even-before-rate-hike