Feels Like The 1980s And 1990s Again

How long can this U.S. market keep going up? Aren’t the markets due for another major bear decline? Why are commodity prices and the TSX so depressed?

How long can this U.S. market keep going up? Aren’t the markets due for another major bear decline? Why are commodity prices and the TSX so depressed?

All good questions. The U.S. stock market (S&P 500 and the Dow) has advanced at a steady ongoing climb since early 2009—seven years—up almost 200 percent, with little deviation. Aren’t bull markets generally four to five years in length?

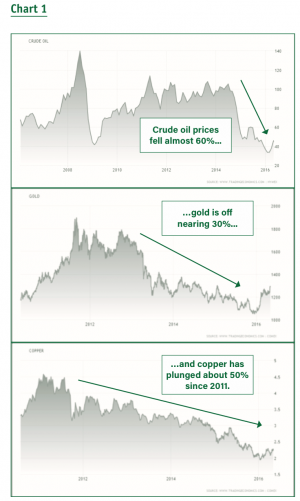

And what about natural resource prices? Oil (WTI) has fallen almost 60% since mid-2014, gold is off nearly 30% since late 2011 and spot copper has plunged 50% since early 2011 (Chart 1).

And how about the TSX? Though still advancing, its sluggish pace (averaging just 3.85% per year over the last three years compared to an average of 10.86% per year for the S&P 500 over the same period) would make any investor question the rationale for placing their funds into it.

Yet, this all has a surprisingly familiar ring to it.

There was another time when the U.S. markets soared continuously, light crude oil prices remained depressed for years, and gold and copper dropped to less than half of their previous value.

We don’t have to look too far back for this comparison. It was the 1980s and 1990s.

We don’t have to look too far back for this comparison. It was the 1980s and 1990s.

Markets tend to go through periods of similar patterns.

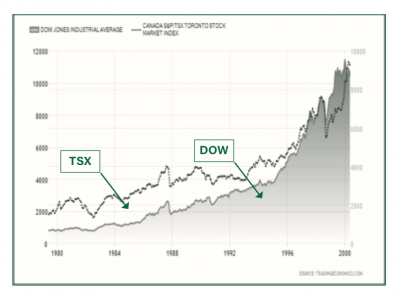

For example, during the 1980s and 1990s, there was great concern about the prolonged rise of the U.S. markets (it lasted for almost 20 years). Many market pundits were constantly calling for a major bear to start at any time. But it didn’t happen (Chart 2).

The TSX had a similar ride to the S&P 500 in the 1980s and 1990s. Both markets climbed up over 1000 percent during that 20-year stretch. The one difference was the “style” of the advance. The U.S. index rose steadily whereas the commodity-heavy TSX moved upwards in a bumpier, more irregular rise.

Gold prices were reaching an all-time high. At the end of the previous commodity cycle, in a one-year span (1979 to 1980), gold soared upwards by 300 percent (in comparison, at the end of the last commodity cycle, from 2006 to 2011, the yellow metal jumped 250 percent). However, after the roaring 1970s, co mmodity prices appeared to “fall off a cliff” in the 1980s. The continuous ride for natural resources, which started in the late 1960s, just stopped as the early 1980s unfolded.

mmodity prices appeared to “fall off a cliff” in the 1980s. The continuous ride for natural resources, which started in the late 1960s, just stopped as the early 1980s unfolded.

For the current market, 2011 was the beginning of another major downturn in commodity prices. Again, natural resources appeared to have just rolled over.

Economically, there were some clear differences between the start of the 1980s and the present market environment. Beginning in 1977, the Fed was waging an ongoing battle against runaway inflation by tightening its interest-rate policies. Rates finally topped out at 20 percent by early 1980. That clearly is not the problem now. Even at the height of last commodity cycle (2008), U.S. inflation topped out at under 6 percent. Inflation in the U.S. right now is at 1 percent and the Fed Funds rates are at 0.25 percent to 0.50 percent.

Where does this lead us? Markets seldom repeat themselves; however, they do have a tendency to follow rhythms. We are seeing many similarities between this current market and the last secular bull market of the 1980s and 1990s. If these parallels continue to play out, and they have so far, we should see long-term strength in the equity markets, primarily in the S&P 500, Dow, NASDAQ, and moderate growth in our TSX (mainly due to its large commodity weighting). Strength in the U.S. dollar is expected along with ongoing weakness in the Canadian dollar.

Bottom line: The current bull market has many similarities to the last bull market in the 1980s and 1990s. Over the last six or seven years, commodities, currencies and equities have moved in comparable paths to the last secular bull market.

Should these parallels continue, and history suggests that they will, then the TSX and the S&P 500 should continue their upward trends, reaching all-time highs. Commodity prices, driven down primarily by the rising U.S. dollar, are expected to remain depressed in the years to come. And the Canadian dollar, which moves in basically the opposite direction to the U.S. dollar, should move lower over the next few years.

Donald W. Dony, FCSI, MFTA is an analyst, a past instructor for the Canadian Securities (CSI) and the editor at the Technical Speculator.com

Email: dwdony@shaw.ca, Ph. 250-479-9463