A Tale of Two Drips

It was the best of DRIPs. It was the worst of DRIPs (with apologies to Charles Dickens).

It was the best of DRIPs. It was the worst of DRIPs (with apologies to Charles Dickens).

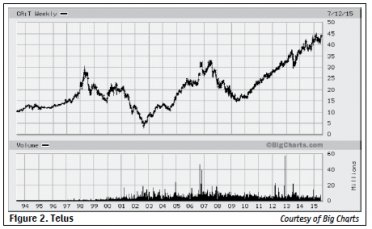

TELUS, the worst of DRIPs, on the other hand has had a varied chart with a couple of dramatic ups and downs. TELUS has split once in this time period, 2 for 1 in April 2013. I began investing in TELUS’s DRIP + SPP around $46 for a split adjusted value of $23/share. TELUS closed today at $44.17, an approximate 100% increase since 1998. The low point for TELUS occurred in 2002 when they invested heavily in fibre optics and traded at a split adjusted low around $2.90/ share or 93% lower than today’s closing price. Telus also severely cut its dividend around this time. The constant refrain in 2002 was “TELUS is going bankrupt”.

couple of dramatic ups and downs. TELUS has split once in this time period, 2 for 1 in April 2013. I began investing in TELUS’s DRIP + SPP around $46 for a split adjusted value of $23/share. TELUS closed today at $44.17, an approximate 100% increase since 1998. The low point for TELUS occurred in 2002 when they invested heavily in fibre optics and traded at a split adjusted low around $2.90/ share or 93% lower than today’s closing price. Telus also severely cut its dividend around this time. The constant refrain in 2002 was “TELUS is going bankrupt”.

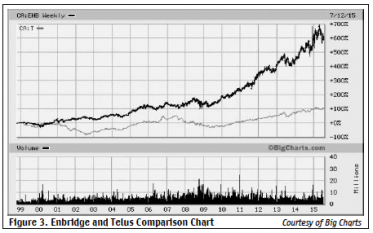

On face value, Enbridge’s 270% increase in value dwarfs TELUS’s 100% increase from the point I started investing in the SPP. How have the two compared over time:

Assuming this chart (Fig. 3) accounts for reinvested dividends, Enbridge’s 600% return since 1999 is a clear winner over TELUS’s meagre 100% return. (Note: My figures above are based on my starting investments at the start of 1998 vs. the combined chart’s start in 1999). However, this fails to take into account the judicious use of a company’s stock purchase plan if offered. Will that have a major influence on an investor’s returns? I have yet to analyze the data as this article is written so we can all be surprised b y the answer.

y the answer.

Before that I’d like to provide some background. There are so many different ways to invest. What works for me might not be suitable to someone else. Thanks to a motorcycle accident I was forced on to disability for 15 years. Mutual funds seemed the only possibility for a small investor on restricted income. Thanks to Mark J. Heinzl’s book, Stop Buying Mutual Funds: Easy Ways to Beat the Pros Investing on Your Own, the error of that approach was quickly corrected. Indexing with funds or ETFs seemed one way to go, however, in 1998 both were still fairly expensive. Besides, to my way of thinking Indexing has a basic flaw: 50% of the index is compared to the other 50%. Believing in regression to the mean, was there a way for a small investor to selectively pick the underperformers believing them to most likely be the future outperformers? Luckily, Cemil (Jim) Otar’s Commission Free Investing, the best Canadian book about DRIPs + SPPs appeared on bookshelves.

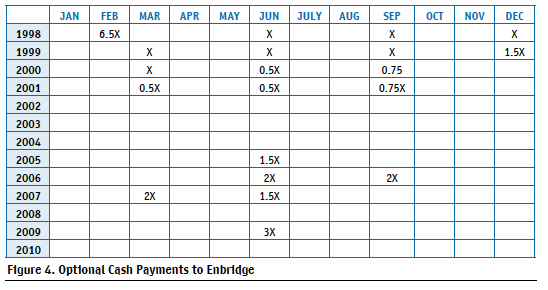

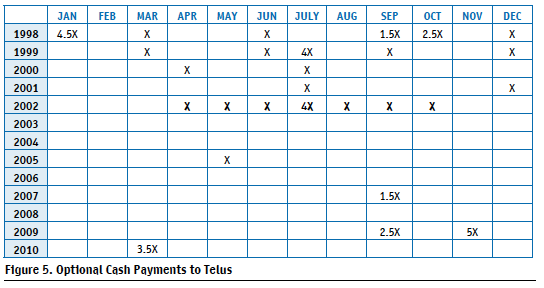

When it comes to DRIPs + SPPs my approach has been to establish a position, continually invest and later use the stock purchase plan when opportunity happens. The following charts demonstrate how I used the SPPs of both Telus and Enbridge. What should be clear is that OCPs (optional cash purchases) were accelerated as Telus’s share price floundered in 2002. I have chosen “X” to represent my usual contributions to each company. 2X would represent a double sized contribution, 3X triple and so on.

A total of 30.50 standard contributions (X) were made from February 1998 to June 2009 to Enbridge. To determine the rate of return requires determining where the 16.25th OCP occurred (30.50/2). Conveniently, this occurred in September 2002.

A total of 49.0 standard contributions (X) were made to Telus from February 1998 to March 2010. To determine the rate of return requires determining where the 24.5 OCP occurred (49.0/2). This occurred approximately the beginning of April 2002.

As previously noted, the approach was to build up a position in both DRIPs with OCPs then let reinvestmentalways underperformingtake place while diversifying to new PLANs. After that only occasional OCPs were made to either Telus or Enbridge where an opportunity, such as a price pull back, occurred. Regular investments in either PLAN stopped in 2001/2002. Enbridge only allows quarterly investments through OCPs, yet clearly in the Telus chart, it can be seen how the monthly investments of the Telus PLAN allowed one to take advantage of its plummeting share price and subsequent recovery mostly in 2002. I was surprised to see that after building a position in Enbridge the occasional OCPs largely occurred in June. Without looking back I suspect Enbridge suffers a seasonal pullback in many years.

Analysis

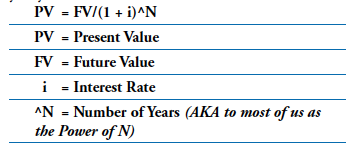

The following formula is used to determine the average yearly return:

Knowing any three values allows the 4th value to be calculated on my Hewlett Packard 10B Financial Calculator. In this situation PV (total OCPs), FV and N are known. Note: I have used the closest whole year and value at that time to determine a good approximation of 'i' or yearly interest rate.

Over 12 years from September 2002 to September 2014 Enbridge returned approximately 18.9% per year with dividends reinvested and using the SPP. Over 13 years from April 2002 to April 2015, Telus returned approximately 14.5% per year dividends reinvested and using the SPP. We all know that a 4.4% difference, as exists between Enbridge and Telus above, will have a tremendous impact over a significant number of years.

But consider this: Over the 16-year period shown in Fig. 3 Telus doubled in value presumably with dividends reinvested.

That’s a 4.4% annual return. By using OCPs and the SPP offered by Telus I was able to boost the annual return, 10.1% to 14.5% and not lose my head as Sydney Carton did at the end of A Tale of Two Cities. Does this make me smart? No, just lucky. After all, I just never got around to starting a Nortel DRIP + SPP where I would surely have lost my head.

Worth noting are the Telus OCPs made in 2002 (bold faced Fig. 5). They account for approximately 30% of the total investment in Telus. The high price paid through the SPP during that period was $8.451/share and the lowest price was $3.9889/share. The average of all purchases in 2002 split adjusted was $6.01. Telus is currently paying $2.20/share in dividends giving a yield on 2002 purchases of 37%. All things being equal, it would be interesting to revisit these two DRIPs in 10 years to see if that helps to further close the gap with Enbridge. That’s the thing about the SPP. Sometimes the guillotine is attached to a rubber band.

In Closing

Many years ago I found an email in my Inbox from Dale Ennis. Canadian MoneySaver was already my favourite financial magazine. “Dear Mr. Gibb, You are the Canadian expert on DRIPping into the USA. Would you consider writing an article for us?” Expert! Me! Boy, do I have some people fooled! Years later I found out that Dr. David Stanley had been lurking my posts at the Motley Fool, knew Dale was looking for someone who would write about DRIPs and suggested he contact me. Thanks Dave, yours was always the first article I read. Somehow an issue just won’t seem right without your mug gracing a page.

Robert Gibb, Victoria, BC (250) 383-7075