My Favorite Economic Indicators And Why They Are Good For Your Portfolio

The world of economics is often by-passed by most investors. They generally prefer fundamentals, relying heavily on earnings, corporate debt and cash flow. Some investors also supplement the fundamentals with technical analysis, viewing momentum, volume and trend as key additions to their investing arsenal.

The world of economics is often by-passed by most investors. They generally prefer fundamentals, relying heavily on earnings, corporate debt and cash flow. Some investors also supplement the fundamentals with technical analysis, viewing momentum, volume and trend as key additions to their investing arsenal.

Yet, when it comes to economics, this valuable resource is more than often by-passed for more familiar methods of stock analysis.

This article presents the value of economics as a tool for market analysis and offers some of my favourite indicators.

Note: Though I have used U.S. economics for my analysis, the Canadian picture basically piggybacks the data coming from south of the border.

U.S. Yield curve:

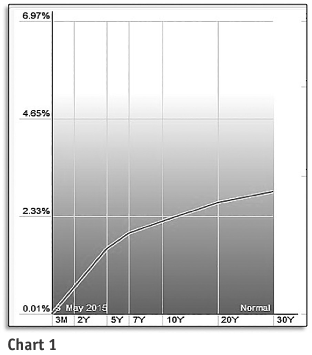

Before each of the last major six recessions, short-term rates ros e above long-term rates, reversing the normal pattern and producing what is called a yield curve inversion. The Fed’s monetary policy greatly influences the slope of the yield curve. A tightening of that policy usually means an increase in short-term interest rates. This is done to ‘cool off’ the economy and extend the economic or business cycle. When those pressures subside, generally rates ease. Long-term interest rates tend to reflect longer expectations and rise less than short-term rates. From an investor’s standpoint, this gradual rise of short-term rates versus long-term rates created by the eventual overheating of the economy provides real clues to the long-term movement of the stock market (i.e. S&P 500). Chart 1 illustrates the current position of the U.S. yield curve. It shows the curve at a normal position with short-term rates well below long-term rates. It also highlights that short-term interest rates have not started to advance, suggesting the business cycle has more growth, and by extension, so does the S&P 500.

e above long-term rates, reversing the normal pattern and producing what is called a yield curve inversion. The Fed’s monetary policy greatly influences the slope of the yield curve. A tightening of that policy usually means an increase in short-term interest rates. This is done to ‘cool off’ the economy and extend the economic or business cycle. When those pressures subside, generally rates ease. Long-term interest rates tend to reflect longer expectations and rise less than short-term rates. From an investor’s standpoint, this gradual rise of short-term rates versus long-term rates created by the eventual overheating of the economy provides real clues to the long-term movement of the stock market (i.e. S&P 500). Chart 1 illustrates the current position of the U.S. yield curve. It shows the curve at a normal position with short-term rates well below long-term rates. It also highlights that short-term interest rates have not started to advance, suggesting the business cycle has more growth, and by extension, so does the S&P 500.

Disposable Personal Income:

In the U.S., consumer spending equals about 70 percent of the Gross Domestic Product (GDP). In Canada, the percentage is slightly less but still makes up a significant portion of GDP. The importance of this measurement is that it illustrates the available extra income for items beyond basic food and shelter. This includes consumer discretionary spending and savings. Chart 2 points out a continued rise in both U.S. and Canadian Disposable Personal Income, which, in itself, is positive for the economy and the markets. Chart 3 shows U.S. personal spending in a continued range since 2010. In fact, over the past 10 years, only in late 2008 and 2009 did the gauge move outside the middle range of 0.00% to +0.10, reaching -1.3% in late 2008 to a sharp rebound of +1.3%. These graphs point out that the largest component of the economy (consumers) is continuing to spend at the same rate as in the past five years. Only a prolonged decrease into negative spending would change that outlook.

Nonfarm Employment:

This economic gauge, in our opinion, has closer ties to the S&P 500 than the other key indicators. Employment is directly connected to the optimism felt in the corporate arena which is reflected in the movement of the stock market. The more optimistic corporations feel, the more hiring develops. A turndown in the economy generally equates to layoffs. Chart 4 shows the tight opposite correlation between the S&P 500 and unemployment. For illustration purposes with the U.S. stock market, we have reversed the Nonfarm Employment to Nonfarm Unemployment to provide a more visual examination of the two groups. Over the last 20 years, U.S. Unemployment levels decreased whenever the S&P 500 rose and unemployment levels increased whenever the stock market fell. Corporate America is quick to reduce employment when a market downturn begins. At present, the unemployment continues to fall, suggesting there is more upside growth in the S&P 500.

Retail sales (YoY):

This indicator is connected to disposable personal income and nonfarm employment, and generally moves with or leads the stock market. Retail sales YoY have been slowly dropping since the high of 2011 and are at the same levels now as 2002. The latest numbers are at 1.30 percent. The 20-year average is 4.55 percent. Canada’s retail sales also show the same weakness. The current reading is 2.50 percent and the 20-year average is 4.44 percent.

Bottom line:

Economic indicators seldom point all in the same direction and this is certainly true with these four key gauges. While the yield curve, disposable personal income and nonfarm employment suggest economic expansion will continue this year, retail sales point to a slowing in spending (which is the biggest component in U.S. GDP) and indicates the possibility of a 2011-style market pullback later this year. However, as indicated by the normal reading from the yield curve, the economy, and by extension the market, is not overheated. Once the yield curve becomes inverted (short-term rates are higher than long-term rates), a market crest is usually not far away. But that is not now. Any short-term pullbacks in the market should be viewed as buying opportunities.

Donald W. Dony, FCSI, MFTA Ph. 250-479-9463

Email: dwdony@shaw.ca