The Five Most Common Investing Mistakes

The hardest part of investing can be learning when to get out of your own way. Despite all of our historical data and experience, there are very few of us who can truly stick to the basics over the long term. That can spell disaster for our portfolios. What’s more, getting the right advice can be difficult. Most investment advisors have high account minimums ($250,000 or more is typical) and charge a premium for their services. It’s no wonder investors make mistakes.

The hardest part of investing can be learning when to get out of your own way. Despite all of our historical data and experience, there are very few of us who can truly stick to the basics over the long term. That can spell disaster for our portfolios. What’s more, getting the right advice can be difficult. Most investment advisors have high account minimums ($250,000 or more is typical) and charge a premium for their services. It’s no wonder investors make mistakes.

Avoiding these common investing mistakes can double your long-term savings and help you achieve your long-term financial goals. Here are five of the most common mistakes that investors can fix today:

Mistake #1:

Paying Too Much In Fees

Canadians pay the highest investment fees in the developed world (more than 2x the USA and 1.5x China), without any compensation from better performance. For example, the TSX 60 returned 9.46% over the past five years versus the 16.7% returned by the S&P 500.

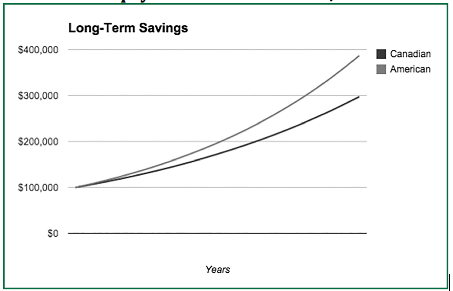

Consider two investors—one based in Canada, the other based in the USA. Each invested $100,000 in a broadly diversified portfolio with an expected long-term annual return of 8%. The American, having paid 1% in fees, would have approximately $385,000 in 20 years. On the other hand, the Canadian, having paid 2.4% in fees, would end up with approximately $295,000 or 23% less.

The fix: never pay more than 1% in fees, ever.

Mistake #2:

Not Contributing Regularly

Do you remember this classic riddle: Would you rather have $1,000,000 today or a penny doubled every day for 30 days? This riddle was how I first learned about the power of compounding (earning returns not just on your original investment, but also on all your previous returns). If you haven’t done the math, the latter option is worth $5,368,709—more than five times the $1,000,000 prize!

Unfortunately, investing won’t double your money every day. However, it should double your money every nine years (assuming the market’s long-term historical return of 8%). That’s why starting early and contributing regularly is so important for your long-term financial well-being. Consider these two friends, Peter and Dave. At 20 years old, Peter starts investing $2,000 per year and then stops after 10 years (and never invests again). On the other hand, Dave starts investing $2,000 per year at 30 years of age, and keeps investing until he retires at 65. Which friend ends up ahead? At age 65, Peter will have $492,000, but Dave will have just $344,000. Despite investing for 20 more years, Dave will end up with $150,000 less retirement savings.

The fix: start early and contribute regularly.

Mistake #3:

Buying High, Selling Low

Investing 101 tells us to buy low, sell high. Yet, investors often do the complete opposite because we are emotional creatures. When the market drops, we panic and sell. When the market booms, we get greedy and buy more. We become our own worst enemies and abandon the discipline required to achieve long-term investing success.

Case in point, consider the 2008 crash. From 2008-2013, investors sold more than $500 billion worth of their equity mutual fund holdings according to the Investment Company Factbook. In 2013, they bought back in for $160 billion, after the stock market had almost completely recovered from the 2008 crash.

Due to emotion (among other things), the average investor underperforms the very investments they own by approximately 1% per year. We observed the impact of a 1% change in returns in our discussion of fees above. So too, the impact of trying to time the market can be disastrous.

The fix: don't time the market. Stick to your plan through market ups and downs.

Mistake #4:

Trying To Pick Winners

There are very few Warren Buffetts out there. So few in fact that Buffett himself in his most recent annual shareholder letter, instructed his estate to invest in a low-fee index fund when he dies. Fewer than 20% of professional stock pickers are able to beat the market in any given year. This data clearly supports Buffett’s decision to stick to index funds for long-term investing success.

The general rule: heed the Oracle of Omaha’s advice and don't try to pick winners.

Mistake #5:

Not Having A Plan

There are many reasons to invest. You could be saving for your first home, for your children’s education, or for a comfortable retirement. The only way to know if you’re on track to meet your goals is to have a plan. Shockingly, only 35% of Canadians have a financial plan according to HSBC. With that in mind, it’s no wonder that 63% of Canadians say their number one concern is having enough money saved for retirement. Beyond helping you actually achieve your goals, a plan can give you peace of mind by telling you if you are on track. If you are off track, it will also tell you how to get back on plan.

The fix: make a financial plan and stick to it.

Avoiding these common investing mistakes can make a meaningful difference to your retirement lifestyle. That’s why we started Wealthsimple—to help every Canadian, regardless of net worth or financial knowledge, avoid mistakes and stick to time-tested investing principles to achieve their long-term financial goals.

Mike Katchen, Founder & CEO, Wealthsimple

1 (877) 222-7473 support@wealthsimple.com