Guaranteeing Retirement Income

The evolution of our adult lives involves working for about forty years (say from ages 25 to 65) and then retiring for twenty-five more (from age 65 to 90). Accumulating a pot of money for the twenty-five retirement years in the forty-some working years depends on your success in saving and investing and possibly being a member of a company pension plan. Because of increased life expectancy, the retirement years are much longer than they used to be.

The evolution of our adult lives involves working for about forty years (say from ages 25 to 65) and then retiring for twenty-five more (from age 65 to 90). Accumulating a pot of money for the twenty-five retirement years in the forty-some working years depends on your success in saving and investing and possibly being a member of a company pension plan. Because of increased life expectancy, the retirement years are much longer than they used to be.

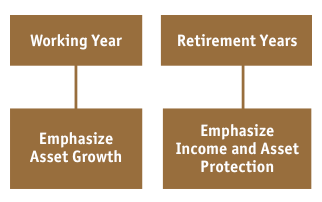

The financial outcome in retirement can be different depending on the choices you make. Hopefully, they are good ones in the income-earning years. Once you retire, your objective should be to switch away from growth-oriented investing to risk-free investing to make sure you hold onto your savings throughout retirement and reach the finish line. That means that as you get older not losing your income sources in retirement should become your number one financial objective.

Personal Savings Or Pension Plan - Choosing Your Investments

Today, defined benefit pension plans are only offered by governments and a handful of corporations. For people working outside such organizations, personal savings are the only way to accumulate the necessary funds for retirement. Fortunately, more and more large corporations are participating in group RRSPs for their employees as a risk-free route for themselves and an incentive for their employees. Company participation can often be up to half of annual RRSP contributions. However, investment risk from RRSPs will fall back on you in retirement. This is not the case for pension-plan income which is guaranteed.

Risk Changes When You Retire

Long-term savings always involve some risk – in theory the more risk the higher your returns should be. That of course is a general statement and if not handled properly, risk can produce very bad outcomes – either no portfolio growth at all or a significant loss of capital if risk is not treated with respect.

When you fast forward to your retirement years, the game changes. During your working years, your investments are directed towards growing your capital by taking on some level of risk. When you retire, your investments are there to provide you with a guaranteed income for the rest of your life. In retirement, there is little if any ability to recover your capital if it is depleted by investment decisions that carry risk. Inflation also depletes your capital over time so you need to factor it in as well. There are ways to recover from investment losses in your working years but practically none in retirement.

You might expect a return of 8% to 12% on your portfolio or RRSP investments in your working years when you are accumulating wealth but in retirement it will probably drop to 5% or less. That’s just the reality of no-risk investing. If reducing the risk of losing substantial capital (like the 30% hit in 2008 that hurt many retirees) is your number one priority, then returns are bound to drop.

So securing a guaranteed income source but protecting your retirement capital is the game you should play when you retire. It seems simple but the shift in the way you manage the new normal can be hard to adjust to—especially if advisors are pushing you in the other direction. You need to tell them to change the dial and give you a new investment policy statement.

Calculating Retirement

Income Needs

In order to determine the guaranteed income that you will need, the first job is to determine your future cost of living. Savings for retirement, mortgage payments and children’s education will be gone but health care, and potentially expensive retirement accommodation will take their place. Other expenses will stay much the same such as house maintenance, car repairs and so on. Optional costs such as vacations and recreation will depend on the size of your wallet.

In the end, let’s say you do the math and settle on a cost of living in retirement of $60,000 a year. Assuming a tax rate of 30%, you will need a before-tax income of around $90,000 in order to have $60,000 left over.

If you are fortunate enough to have a company pension plan, some of the pressure to achieve a full guaranteed income is gone. Of course, you should have Canada Pension and Old Age Security which are guaranteed and inflation-adjusted. That is the starting point for a plan for your guaranteed income needs calculation. Now, you will have to determine where the rest of your retirement income will come from. If this first level of guaranteed income adds up to, say, $50,000, you need to determine where the remaining $40,000 of guaranteed income will come from. That’s right, guaranteed income.

Your Retirement Assets

Let’s say when you retire that you have $550,000 in your RRSP (soon to become a RRIF) and $250,000 in investments and your home is worth another $450,000. Good advice would say that you should plan to guarantee at least half of the $40,000 mentioned above. That goal has some flexibility depending on your total investment assets.

The obvious place to start to look for the $40,000 is your RRSP money. It is, of course, an income-generating asset in the first place. Will you take a RRIF (with investment risk exposure) or will you turn your RRSP or (at least in part) into an annuity with a guaranteed term that lets you preserve some of your capital if you die early?

Your remaining investments should be structured as a risk-sensitive buffer after the guaranteed income need is taken care of, and this will dictate how conservative you will be in investing these remaining assets. Of course, if you have significantly more assets than described in the case above, they can be held to be used in part for extra unexpected expenses or possibly for gifts to your family or a charity if you are so inclined.

How Much Annuity Should I Buy?

This family decides that they want to increase their guaranteed income by another $20,000 by purchasing an annuity. It will cost approximately $300,000 because today’s annuity rates indicate that $100,000 will provide an annuity of $6,000 a year for a male age 70. The cost will depend on the length of any annuity guarantee.

In summary, at this point the family now has guaranteed $70,000 of the total $90,000 of needed income and is left with the following income supporting assets after the annuity purchase.

RRSP $250,000

Investments $250,000

$500,000

This $500,000 of remaining assets if invested conservatively should more than take care of the final $20,000 of annual retirement income. This need for cash income can come either from income on the investments or a draw-down of capital or both.

The Rrif Or Annuity Decision

When your RRSP matures, it can be converted to a RRIF or an annuity. Most people choose the RRIF option and put their entire RRSP investment amount right back into risk. That’s a bad choice. Annuities don’t carry this risk of loss to income despite other drawbacks that they are perceived to have.

Funny thing—pension plans (which essentially are annuities) are so coveted by those lucky enough to have them and even by those who don’t. Why then are annuities looked at with such skepticism when they really are the same thing as pensions? I am not sure. Get over it and invest a good chunk of your RRSP money in an annuity as your financial situation dictates.

Layers Of Retirement Savings

I see retirement savings in three distinct pots as follows:

Guaranteed Income Pot (income certainty)

Capital Preservation Pot (capital preservation with modest income)

Investment/Legacy Pot (growth with some capital risk)

These will be discussed below.

Guaranteed Income Pot

This is the pot of assets that you can be completely sure will generate income for the rest of your life. There are no ifs, ands or buts. The only assets that really qualify in this pot are pensions (private and government) and annuities. Hopefully they have inflation protection but if not their value as an income protector is not one hundred cents on the dollar.

Capital Preservation Pot

The second pot of assets are those whose capital is virtually protected but they still produce modest income for your retirement. This pot could contain such things as segregated funds, laddered GICs or high quality corporate or government bonds (in an ETF) to name a few of the assets that meet the test.

Assets in the capital preservation pot should be simple for you to understand. Bonds and GICs meet that criteria. They allow you to know for sure that your capital will never disappear. This class of investments is littered with financial products offered by financial institutions. The SEG fund is the most well-known but there are others. Avoid them! The fees are almost always exorbitant and the products are complex and hard to understand—advantage to the financial institutions.

This second building block is important for capital protection and with assured income. The assets could be inside or outside a RRIF.

Investment/Legacy Pot

The last pot of savings is the pot that you will keep invested in the market and hopefully it will show some growth. It also can support an extra need for income but there always can be some chance of loss. Investments such as stocks, bonds, mutual funds and ETFs in this pot should be in blue-chip, investment-grade assets to keep risk low. They are known as value investments.

There are some stocks that produce dividend income year after year with low price volatility. That’s the kind of stocks that you want in this class. Stocks in companies that are utility type companies—an Enbridge or a CNR for example. ETFs are an increasingly popular option as they should be and can fit into this class. They offer a broadly diversified asset base with fees that are dirt cheap.

A higher ratio than normal of bonds relative to stocks in your investment/legacy portfolio helps to lower risk as well.

Is An Annuity A Bad Choice?

Some retirees see red when they think about purchasing an annuity because of the possible loss of capital should they die early. However, that loss can be hedged by including a guaranteed term. It will cost you a little in annual return but it will be well worth the money. Once you are over 70, the return on an annuity stacks up well against other conservative investments and provides income certainty to boot—which of course you need.

In fact, the loss of capital when buying an annuity is usually overstated in terms of importance. What you don’t need is to run out of income and an annuity ensures that does not happen. If you die early, you may lose more than you would like but if you live a long life, an annuity will make you a winner with a certain return until you die. An annuity is an income product and an insurance policy all in one. You need to pay for the insurance element.

Here’s a summary comparing investing your RRSP funds a RRIF or buying an annuity.

ANNUITY

- Income certainty

- Guaranteed income for life

- No investment decisions

- Not relying on advisors

- Capital protection options available

- Will not outlive your income

RRIF INVESTING

- Income uncertainty

- Investment success determines income

- Investment management required

- Relying on advisors

- No capital protection

- Can outlive your income

- One Stop Shopping Doesn’t Work

The types of securities offered by financial institutions are very segmented. They are probably organized that way because of regulatory and licensing rules. The fact of the matter is that a bank has a limited range of investment options that differs from an insurance company or mutual fund representatives. Each is going to tout their product and try to convince you that it is better than other products that you want but they don’t sell.

Go down the street and buy the other product that needs to be in your plan. If you need GICs for capital preservation go to a bank; if you need an annuity, hike to a life insurance company; if you want to buy stocks or ETFs, find advisors who sell them.

Conclusion

So instead of thinking only about a RRIF purchase when heading into retirement, think about buying an annuity for an amount that lets you sleep at night. Moreover, keep all of your investments in things that are simple and easy to understand. Stocks, bonds, mutual funds, ETFs and GICs should do it all. Avoid complicated financial products sold by financial institutions that you don’t understand and that almost always carry high fees.

J. E. Arbuckle Financial Services Inc.

30 Dupont St. E., Suite 205, Waterloo, Ontario N2J 2G9

Phone: 519-884-7087 Fax: 519-884-7087

Email: jea@finplans.net