Channeling George Costanza: Your Behaviour Matters

There is a wonderful episode of the Seinfeld TV series that every investor should embrace. In the episode, George returnsfrom a walk on the beach, where he had contemplated his “loser” life, and declares to Jerry, “It became very clear to me sitting out there today, that every decision I've ever made in my entire life has been wrong. My life is the opposite of everything I want it to be. Every instinct I have in every aspect of life, be it something to wear, something to eat... it's all been wrong.” Jerry convinces him that "if every instinct you have is wrong, then the opposite would have to be right."

There is a wonderful episode of the Seinfeld TV series that every investor should embrace. In the episode, George returnsfrom a walk on the beach, where he had contemplated his “loser” life, and declares to Jerry, “It became very clear to me sitting out there today, that every decision I've ever made in my entire life has been wrong. My life is the opposite of everything I want it to be. Every instinct I have in every aspect of life, be it something to wear, something to eat... it's all been wrong.” Jerry convinces him that "if every instinct you have is wrong, then the opposite would have to be right."

George then resolves to start doing the complete opposite of what he would do normally. He orders the opposite of his normal lunch and introduces himself to a beautiful woman, who happens to order exactly the same lunch, saying, "My name is George. I'm unemployed and I live with my parents." To his surprise, she is impressed and agreed to date him. Thanks to his date, George gets an interview with the New York Yankees, where he also does the opposite of his instincts and tells George Steinbrenner that he hates his management decisions and despises the way the Yankees are managed. Steinbrenner hires him immediately and he lands the job of Assistant to the Traveling Secretary. He moves out of his parents' house and makes sure he tells them how much he loves them—again, an example of "opposite" behaviour.

The short sharp 10% market correction in the S&P 500 from September 18 to October 16 was harrowing and scary. I would guess a lot of investors succumbed to the fear and panic, and sold into the sell-off, compounding an already bad situation. Fear begets fear. Selling begets selling. However, the rational thing to do is to step back, examine what has changed and see whether or not the changes were based on rational thought.

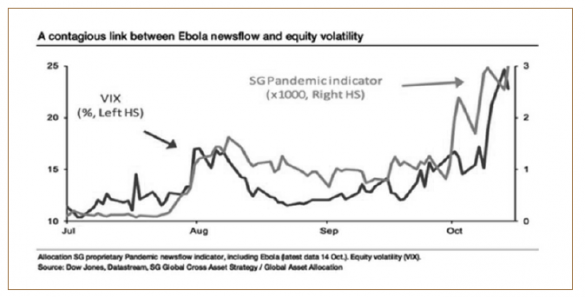

As I witnessed this unfold, I saw that the US economic picture was improving, albeit slowly, with all my main indicators flashing positive signals. The factors I put the most credence into are US unemployment data, housing starts, industrial production, interest rates, and auto sales. These five factors, along with the drop in energy prices, all pointed towards a brighter—not darker—future for US equities. The only negative item that I could factor into the sell-off that was not already known to the market (and there were several macro issues out there like ISIS terrorism, the conflict between Russia and Ukraine, American and EU sanctions against Russia, and continued unrest in Gaza) was the unfolding news that an Ebola case had occurred in Dallas in late September. Ebola on US soil was a major news item and on the night of October 15, I watched Steve Paikin, Anderson Cooper 360 and several other news shows all covering this “outbreak.” The market correction we were witnessing was in direct correlation to the fear of an Ebola outbreak on US soil. As usual, the media was hyping this fear on all available channels and while Ebola is very serious, I believed that the market reaction was a typical overreaction… so, I recommended to my clients that we “do the opposite” and buy. The fundamentals were still quite positive overall and outside of energy shares, all the lights were flashing green to me.

Psychologically, we are not programmed to buy market dips in the face of declining prices as we are, in essence “running into burning buildings” while our fight or flight instinct kicks in telling us to run the other way. The natural tendency when investors feel pain is to hit the sell button for instant gratification. The market losses of 2008-2009 are still seared in our collective minds and while the market has risen substantially since 2009, most investors don’t trust this market and have one foot out the door at all times. I try to reframe the situation for my clients by asking, “who do you think is buying during this decline?” since, by definition, for every seller, there is a buyer. I also use a friendly reminder that is on my outgoing emails below my signature, which is simply a piece of advice from Warren Buffett: “Let the market serve you, not guide you.” This completely turns the situation around and treats the stock market like the supermarket: when tuna goes on sale at the supermarket we tend to buy more, not less. When stocks get temporarily cheaper, don’t sell them, buy them.

According to the latest 2014 release of Dalbar’s Quantitative Analysis of Investor Behavior (QAIB), the average investor who is in a blend of equities and fixed-income mutual funds has garnered only a 2.6% net annualized rate of return for the 10-year time period ending December 31, 2013. Investors may only have themselves to blame. According to Dalbar’s QAIB, investors make poor investment choices that hurt their investment returns. These decisions, including when to buy and sell, are often driven by fear and emotion. Conventional financial theory suggests that investors are rational and seek to maximize their wealth through objective, non-emotional investment decisions. That makes sense. Nobody invests with the goal of losing money. However, the emotions of fear and greed, along with herd instinct, have long been thought to be the main drivers of markets and investor behaviour which lead to irrational investment decisions. To offset this tendency, I often run “fire drills” for my clients when markets are buoyant, asking them to consider taking money off the table and reduce winners and add to more conservative investments. Often, they are unwilling to make the change since the “high” that their portfolios give them overwhelms rational thought. Investors need to understand their emotional weaknesses and guard against short-term wealth-destroying behaviour and act more like George Costanza by “doing the opposite” of the herd.

Angelo Vicere, B. Comm., CFA is a Senior Financial Advisor and Branch Manager with Assante Capital Management Ltd. in Hamilton, ON. Please contact him at (866)-418-9900 x222 or (905) 574-9900 x222 or avicere@assante.com to discuss your particular circumstances prior to acting on the information above.

This publication contains opinions of the writer and may not reflect opinions of Assante Capital Management Ltd.