Total Return Investing – Mutual Funds, ETFs Or Individual Stocks?

The years of low returns on fixed income investment products stretch on. Higher rates are prophesized to appear ‘soon’, but have yet to materialize. And when they do, most observers think the increases will only be incremental, with central banks unwilling to threaten what has so far been a very fragile economic recovery. Yet, inflation has started to creep up in Canada (2.36% annualized as of June 2014), food and fuel costs being two of the main culprits. Higher inflation but miniscule returns on government bonds and GICs — every retiree’s worst nightmare.

The years of low returns on fixed income investment products stretch on. Higher rates are prophesized to appear ‘soon’, but have yet to materialize. And when they do, most observers think the increases will only be incremental, with central banks unwilling to threaten what has so far been a very fragile economic recovery. Yet, inflation has started to creep up in Canada (2.36% annualized as of June 2014), food and fuel costs being two of the main culprits. Higher inflation but miniscule returns on government bonds and GICs — every retiree’s worst nightmare.

What are our seniors to do? What they have been doing is buying more Canadian equities, which is totally understandable given the large discrepancy in returns between equities and fixed income. These purchases have been mostly in the form of mutual funds and ETFs. Readers of this column know that I, along with a great majority of financial commentators, have an aversion to mutual funds because of their high fee schedule and poor results. Exchange-traded funds or ETFs have substantially reduced costs since they, in the main, invest passively in broad market indices with much lower portfolio turnovers than active stock picking.

Ellen Roseman has noted that mutual fund assets have grown by an average 19.4 per cent a year for the last 20 years and that more than a third of Canadian households hold mutual funds (http://www.thestar.com/business/ personal_finance/2014/01/26/why_etfs_have_lost_ ground_to_mutual_funds_roseman.htm). She also notes that there has been a shift recently resulting from the U.S. Federal Reserve announcing that their quantitative easing program of purchasing bonds would taper to an end, thus leading to an increase in interest rates.

Many Canadian investors cashed in their ETFs and began purchasing balanced mutual funds, which are actively managed products that juggle the ratio of stocks, bonds, and cash in an attempt to maximize total returns.

Results for the 12 months ending in June 2014 showed balanced funds leading the sales of mutual funds in Canada, up over 100% compared to June 2013. While total ETF assets rose 18% year-over-year and the number of ETFs reached 301, ETF assets still represent only 6.4% of total mutual fund assets in Canada (http://www.valuewalk.com).

Have these Canadian balanced mutual funds rewarded investors? The June issue of the Canadian MoneySaver gives the results for the top 20 Canadian balanced funds as of April 30, 2014 (pg. 39). These averaged annual total returns of 14.01% for 5 years and 7.56% for 10 years (not all funds had a 10-year longevity), with an average MER of 2.03%. In the same issue (pg. 42) is a list of top Canadian ETFs. The only two balanced funds listed are iShares balanced growth (CBN) with a 5-year total return of 11.00% and a MER of 0.80%, or iShares balanced income (CBD) with a 5-year total return of 10.00% and a MER of 0.72. Both these ETFs appear to be amalgams of other ETFs in an attempt to achieve a balance of equity and fixed income components.

I suppose the ETF passive model doesn’t align very well with an active balanced mutual fund where the ratios of stocks to bonds to cash are always being altered. Perhaps a future ETF product might be designed to compete in this market. I would think an index fund that puts 50% into a S&P/TSX 60 total return index and 50% into a laddered GIC index could be a start.

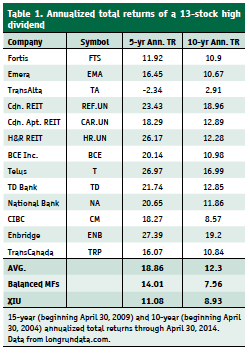

What about stocks? Are we forced to buy balanced mutual funds with their high MERs or can we construct our own portfolio of stocks that will do the same or even a better job? I thought this idea was worth investigating so I put together a group of 13 Canadian blue-chip stocks from those that had appeared in our BTSX portfolio over the years along with some REITs. These are stocks I currently own or have owned; the majority are ones I have owned for over 15 years. It seemed to me that if we were to have a portfolio of only stocks, they should be stocks with healthy dividends to make up for the lack of fixed income.

Dividend income combined with capital gains result in a total return that should exceed what might be expected from balanced funds in a period of very low interest rates.

My experience with dividend stocks has shown that the best sectors to invest in are telecoms, utilities, real estate, and financials, or as I call them, the TURF stocks. Although I normally include pipelines in utilities, here I have split them into a separate category. The resulting 13-stock portfolio is shown in Table 1. This is not cherry picking or data mining since, as you can see, there are some laggards in this group; F TS, EMA, TA, and CM come to mind. I maintain that this is a very generic collection of stocks that any fund manager might have chosen. The current yield of this group of stocks is4.20%, as compared to 2.24% for XIU and 2.11% for a BOC 10-year bond.

TS, EMA, TA, and CM come to mind. I maintain that this is a very generic collection of stocks that any fund manager might have chosen. The current yield of this group of stocks is4.20%, as compared to 2.24% for XIU and 2.11% for a BOC 10-year bond.

Our small (many mutual funds own hundreds of stocks) collection of high-dividend stocks outperformed by quite a wide margin the total return average of the top 20 Canadian balanced funds for both 5 years and 10 years. In fact, this group topped 19 out of the 20 mutual funds in 5-year returns and all of them in 10-year returns.

Since historical results for the total returns of Canadian stock indices (S&P/TSX Composite; S&P/TSX 60) are considered proprietary by the owners and require a paid subscription, I use total returns for the iShares S&P/ TSX 60 Index ETF (XIU) as a proxy. Our portfolio also beat the index handily. Yes, I know that dividends can go down as well as up, as TA demonstrated recently, but with a portfolio whose yield is twice the current rate for a Bank of Canada 10-year bond I feel pretty good about our chances of beating balanced mutual funds going forward. I should note that it has always been difficult for individual investors to gather data for Canadian stocks. Now, however, a new (to me) website (longrundata.com) provides not only annualized total returns but also the growth of a given dollar investment, annualized dividend growth rates, and 30-year annual dividend histories. I compared data from this site with those from one I often use – Yahoo Finance Canada (https://ca.finance.yahoo.com/) and found very high precision. Thanks to John Heinzl at the Globe and Mail for reporting on this useful tool (http://www.globeinvestor.com/).

Thus, individual investors have a choice of either purchasing a balanced mutual fund that in any given time period may or may not produce adequate returns, or setting up a portfolio of high-dividend blue-chip Canadian stocks and holding for a reasonably long time. The portfolio I constructed in this column represents my thoughts; I’m sure you will have your own ideas. The advantages of buying and holding individual stocks are apparent. The only disadvantage I can see is the trouble and cost of portfolio building, but with today’s inexpensive online brokerages this is significantly minimized both in terms of fees and time required.

As always, I hope this column will generate discussion and I will attempt to answer your questions within the guidelines set by the Canadian MoneySaver.

David Stanley, Ph. D., P. O. Box 12, Rockwood, Ontario